Loan Service Providers: Helping You Realize Your Monetary Ambitions

Wiki Article

Locate the Perfect Financing Providers to Satisfy Your Monetary Goals

In today's complicated financial landscape, the pursuit to find the perfect loan services that straighten with your unique financial goals can be a complicated task. With many alternatives offered, it is essential to browse through this labyrinth with a strategic method that ensures you make informed choices (Loan Service). From comprehending your economic demands to evaluating lending institution online reputation, each step in this procedure needs careful factor to consider to secure the ideal feasible result. By following a methodical technique and evaluating all variables at play, you can place on your own for financial success.Examining Your Financial Needs

When taking into consideration finance solutions for your financial objectives, the initial step is to extensively assess your present financial needs. Begin by examining the certain function for which you require the finance.

In addition, it is vital to perform a detailed evaluation of your current economic circumstance. Take into consideration variables such as your credit history score, existing financial obligations, and any type of upcoming expenses that may affect your capacity to settle the car loan.

Along with understanding your financial requirements, it is advisable to research and contrast the loan options available on the market. Different financings come with varying terms, rate of interest, and repayment timetables. By meticulously analyzing your demands, monetary setting, and offered car loan items, you can make an informed decision that sustains your economic objectives.

Comprehending Car Loan Options

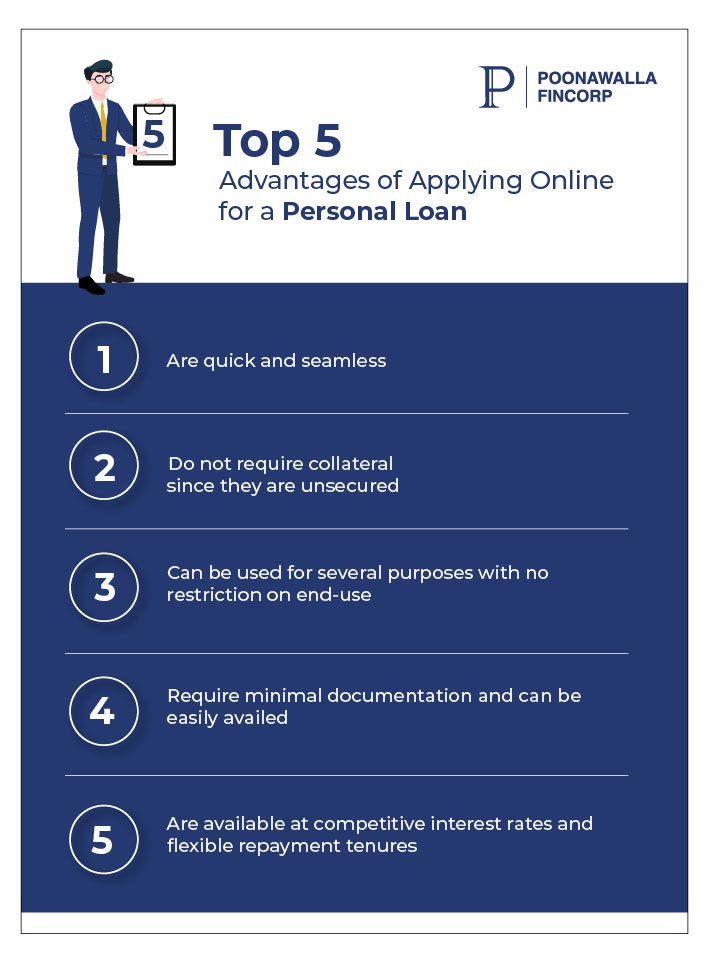

Discovering the variety of lending alternatives available in the monetary market is important for making notified decisions straightened with your specific requirements and goals. Understanding lending options includes familiarizing yourself with the different kinds of loans offered by monetary institutions. These can range from traditional options like individual car loans, home mortgages, and car fundings to more specific items such as home equity loans, payday advance, and student car loans.Each kind of loan features its own terms, problems, and repayment structures (merchant cash advance providers). Personal finances, as an example, are unsafe loans that can be used for different objectives, while home loans are protected fundings especially designed for buying property. Car lendings cater to funding vehicle acquisitions, and home equity finances allow house owners to obtain against the equity in their homes

Comparing Rate Of Interest and Terms

To make informed decisions pertaining to financing choices, a critical action is comparing rate of interest rates and terms offered by monetary establishments. Comprehending and comparing these terms can aid debtors select the most appropriate finance for their financial situation. In addition, evaluate the influence of car loan terms on your financial goals, guaranteeing that the chosen loan lines up with your spending plan and lasting objectives.Assessing Lending Institution Reputation

In addition, think about consulting regulative bodies or financial authorities to ensure the lender is certified and compliant with market laws. A credible lending institution will have a solid track document of ethical financing techniques and transparent communication with consumers. It is also helpful to seek recommendations from good friends, family members, or economic experts who might have experience with reliable lenders.

Ultimately, selecting a loan provider with a strong credibility can offer you assurance and confidence in your borrowing decision (business cash advance lenders). By conducting complete study and due persistance, you can pick a loan provider that lines up with your financial goals and worths, establishing you up for a successful loaning experience

Selecting the most effective Lending for You

Having thoroughly examined a official site lender's track record, the following important step is to carefully pick the most effective funding option that aligns with your financial objectives and demands. When choosing a lending, consider the objective of the finance. Whether it's for purchasing a home, combining debt, moneying education, or starting a company, different finances cater to particular demands. Examine your monetary situation, including your income, expenditures, credit report, and existing financial obligations. Comprehending your economic health will certainly help determine the kind of car loan you qualify for and can pleasantly settle.Compare the rate of interest, finance terms, and charges used by different lenders. Reduced rates of interest can conserve you money over the life of the car loan, while positive terms can make payment a lot more manageable. Aspect in any type of extra costs like origination charges, prepayment penalties, or insurance coverage needs.

Select a finance with monthly payments that fit your budget plan and duration for settlement. Inevitably, choose a car loan that not just meets your present financial demands yet additionally supports your lasting monetary goals.

Final Thought

Finally, locating the ideal lending solutions to fulfill your monetary objectives calls for a detailed assessment of your monetary demands, recognizing loan choices, contrasting rates of interest and terms, and assessing loan provider online reputation. By thoroughly considering these aspects, you can choose the most effective lending for your particular situation. It is necessary to prioritize your economic purposes and select a loan that straightens with your long-lasting financial objectives.Report this wiki page